According to the European Pultrusion Technology Association (EPTA), more architects and engineers are discovering the benefits of pultrusion and incorporating pultrusions into construction projects.

What has contributed to this growing popularity? What benefits does pultrusion offer over conventional materials and methods? What types of products can be created and used in such a wide range of industries?

This article will examine the expanding popularity of this fabrication process and discover why it's the go-to solution for industry leaders.

The global trend.

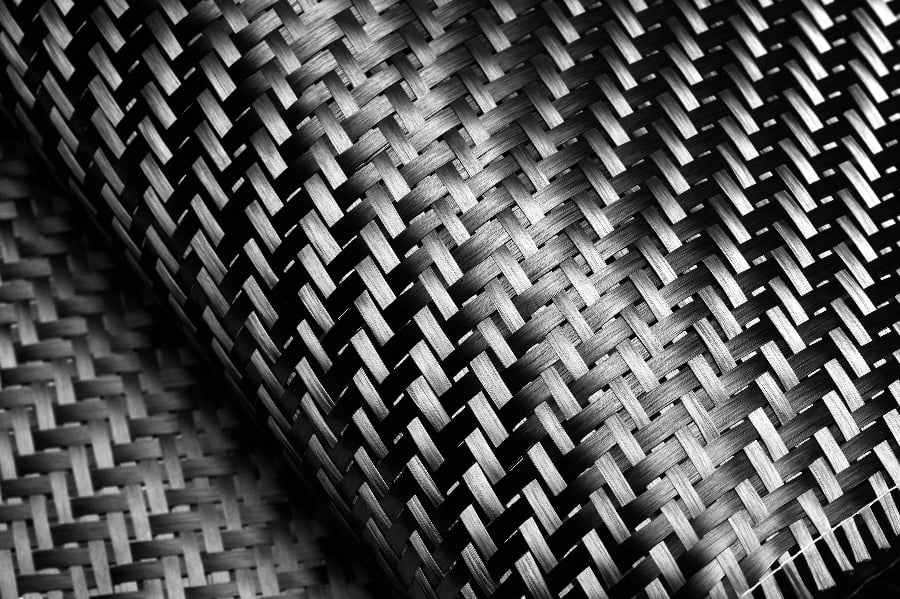

There is a worldwide demand for sustainable products that have created a hot market for lightweight, strong, and durable composites. The trend is seen across all industries including transportation, energy, and construction.

Pultrusion has made inroads into several industries that share the common goal of moving in cost-conscious and environmentally-conscious directions.

One industry realizing the value of composite materials is the wind-power industry. Pultruded windmill blades offer a lower cost of up to 12%, 10% reduction in capital expenditure, and each pultruded blade is as much as 7% lighter.

Additionally, other main windmill components, such as spar caps, can also be pultruded. Lower-weight, more cost-effective materials means cheaper, more abundant sources of energy with a vastly improved lifecycle and reduced environmental impact.

In the automotive industry, composites are seen as a way to provide light-weight, fuel-saving materials that don’t compromise safety or structural integrity. Pultrusion applications include bumper beams, roof beams, front-end support, door beams, chassis rails, and transmission parts.

Ever since the fuel crisis of the 1970's, car companies have struggled to make their vehicles as light and fuel efficient as possible while protecting customers and meeting rigorous safety standards. Pultrusion techniques and composite materials seem to be emerging solutions for automotive manufacturers.

A growing market.

The pultrusion industry is expected to reach $110 billion by 2022. Composites currently have little market penetration, which means there is plenty of opportunity for further growth.

These are the key factors that lead to investor backing and allow new industries to thrive in the global market. With proven clinical success and the promise for untapped avenues of expansion, pultrusion is almost guaranteed to play a big part on the economic stage.

Industry analysts are predicting a compound annual growth rate of about 5% in the coming years. Construction and infrastructure are anticipated to be the leading growth sectors.

North America is already a key player in this arena, accounting for a third of the current global composites market. Dan Coughlin, VP of Market Development at the American Composites Manufacturers Association (ACMA), reports that pultrusion currently makes up 3% of the North American product market for composites.

According to Coughlin, one of the key limiting factors to growth is the lack of awareness of the benefits of pultruded products. All signs point to this changing, however, as evidenced by industry acceleration

New industry incorporation.

Another great sign that the pultrusion market is taking off is that it is being adopted by industries as a replacement to long-standing, traditional construction methods. One such application of pultruded products that is showing considerable growth is in the replacement of steel rebar (a $120 billion global market).

Estimates suggest that 1 in 9 US bridges is structurally compromised largely due to rebar corrosion. Pultruded rebar is corrosion resistant and offers a high strength-to-weight ratio.

Tests have shown that pultruded rebar retains nearly all of its physical properties after 15 years of service, outperforming its traditional metal counterpart which begins to show signs of weakening at that time.

Telecommunication companies are also discovering the superiority of pultrusion in the manufacturing of lines and cables. These companies are developing infrastructure to handle the increased demand of the 5G era.

Companies have discovered that pultruded glass fiber can reduce attenuation of the high-frequency 5G signals. New resins and process technology are growing to improve performance over traditional resins such as unsaturated polyester and vinyl ester.

In the data and communication industry, this can mean higher line speeds without affecting other line properties (e.g. resistivity).

The most recent EPTA conference was the largest in 14 years. Representatives from North and South America, India, and South Africa joined their European counterparts to discuss the groundbreaking changes taking place in the pultrusion industry.

According to event organizers, “the high level of technology and application development activities showcased in the wide-ranging conference program is evidence of a strong determination to improve the competitiveness of pultruded products and pursue growth opportunities. ”

The next EPTA conference will take place in March of 2020.